Or sign in with

Content

You are required to meet government requirements to receive your ITIN. DE, HI and VT do not support part-year/nonresident individual forms. Most state programs available in January; software release dates vary by state. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Specify additional withholding.As mentioned above, you have the option on the W-4 form to enter an additional amount you want to have withheld with each paycheck.

If you received an IRS letter, we can be with you every step of the way to help solve it. You’ll provide your completed Form W-4 to your employer. The new W-4 tax form took effect starting Jan. 1, 2020. This could impact your refund or what you owe. We’ll help you understand them to avoid surprises. Small Business Small business tax prep File yourself or with a small business certified tax professional.

How To Calculate Your Tax Withholdings, however, must keep payroll records for the specific lengths of time mandated by federal and state governments. First, gather all the documentation you need to reference to calculate withholding tax. The withholding tax amount depends on a number of factors, so you’ll need the employee’s W-4 to help with your calculations, as well as the withholding tax tables and the IRS worksheet.

Medicareis also a flat tax, at a rate of 1.45%. There is no annual limit for Medicare taxes, but employees who earn more than $200,000 a year are subject to what’s called the Additional Medicare Tax of 0.9%. We multiply our employee’s gross wage of $2,083.33 by 1.45% and arrive at $30.21 for Medicare tax.

Common life events can change your tax liability. To avoid being caught off guard, you’ll need to adjust your withholdings on your paycheck. Once you have an idea of how much you owe the IRS, it’s time to compare that amount to your total withholding.Take your annual tax withholding and subtract your estimated tax liability.

There’s still time to get your taxes done right with Harness Tax. Your income exceeds a threshold set by the IRS and you or your spouse are also covered by a 401. This calculator assumes your IRA contributions are not tax-deductible if you already contribute to a 401.

Faster access to funds is based on comparison of traditional banking policies for https://quick-bookkeeping.net/ deposits versus electronic direct deposit. H&R Block Free Online is for simple returns only. You are presented with an amount that you owe in taxes from the output of our W-4 calculator and your desired tax refund amount is $0.

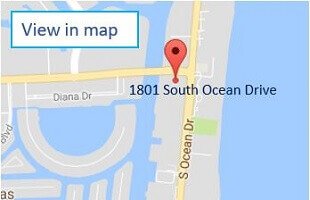

1801 South Ocean Drive, Suite C Hallandale Beach, FL 33009

1801 South Ocean Drive, Suite C Hallandale Beach, FL 33009

ДЛЯ БОЛЬШЕЙ ИНФОРМАЦИИ ЗВОНИТЕ НАМ

(786) 797.0441 or or: 305 984 5805