Or sign in with

For example, suppose the market is experiencing a pullback within a prevailing trend. In that case, you can take advantage of the levels set by Fibonacci and place your trade in the direction of the underlying trend. When a stock is trending up or down, it usually pulls back slightly before continuing the trend.

It can be naturally found in spiral shapes that form seashells, constellations, flowers, etc. More importantly, it is believed that Fibonacci retracement also affects how humans behave. In our narrative, it applies to how the prices can fluctuate in the crypto market. The retracement helps traders understand how to use technical analysis effectively. Fibonacci retracements are used by quite a few traders in various markets. They are used by short-term traders, long-term traders, and investors alike.

For unknown reasons, these Fibonacci ratios seem to play a role in the stock market, just as they do in nature. Technical traders attempt to use them to determine critical points where an asset’s price momentum is likely to reverse. The best brokers for day traders can further aid investors trying to predict stock prices via Fibonacci retracements.

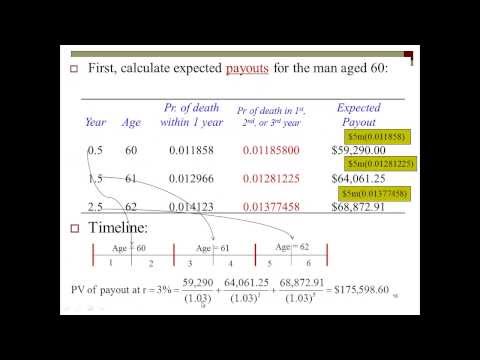

Chart 1 shows Home Depot retracing around 50% of its prior advance. Fibonacci retracement levels are created by dividing the vertical distance between the high and low points by the key Fibonacci ratios. This is done by drawing horizontal lines on the trading chart at 0.0%, 23.6%, 38.2%, 50%, 61.8%, and 100%. Though not an official Fibonacci ratio, traders also like to use the 50.0% ratio because often, the price will retrace by around 50% before continuing its original trend. The idea is that the new high or new low is only a temporary end to the trend, and there will be a market correction or reversal at these Fibonacci retracement levels.

However, to draw the Fibonacci retracement in uptrend, you will need to attach the tool to the bottom and drag it up to the top. Conversely, when drawing the Fibonacci retracement on downtrend, attach the tool to the top and drag it to the bottom of the trend. However, traders often use it because of the tendency of asset prices to continue in a particular direction after a 50% retracement.

More importantly, you will learn to apply the automatic Fibonacci retracement tool using real-world Fibonacci retracement examples in crypto markets. Fibonacci retracement tools can be used by drawing from the swing low to the swing high. This fans out multiple levels that people will be paying attention to who is a Fibonacci-based trader. It’s also a very subjective type of technical analysis, so you need to be aware that different people will look at it through a different prism. Because of this, Fibonacci is more likely than not to be successful if you use it with another type of analysis, perhaps price action.

The red candlestick and gap down affirmed resistance near the 62% retracement. There was a two-day bounce back above 44.5, but this bounce quickly failed as MACD moved below its signal line (red dotted line). Fibonacci retracement lines are typically employed as part of trend-trading strategies.

All About Fibonacci Extensions: What They Are, How To Use Them.

Posted: Sun, 26 Mar 2017 03:43:39 GMT [source]

For example, it does not make sense to use the Fibonacci Retracement point when an asset is ranging. It is also not recommended to use the retracement when an asset is highly volatile. You will meet those who believe in swing trading and others who believe in day trading (See also Day Trading vs Swing Trading). Before we can understand why these ratios were chosen, let’s review the Fibonacci number series.

It is worth noting that the 50% Fibonacci level is not an actual Fibonacci level. It does not occur mathematically; instead, it is simply a throwback to the way traders used to buy dips in a market. Usually, traders place a Stop Loss order just below the next Fibonacci level after they buy an asset or above the next level after they sell one. The best practice for using the Fibonacci Retracement is to focus on the long-term chart.

Often, it will retrace to a key Fibonacci retracement level, such as 38.2% or 61.8%. These levels offer new entry or exit positions in the direction of the original trend. Fibonacci levels also arise in other ways within technical analysis. For example, they are prevalent in Gartley patterns and Elliott Wave theory. After a significant price movement up or down, these forms of technical analysis find that reversals tend to occur close to certain Fibonacci levels.

This concept is known as Fibonacci Retracement, developed using the ideas of the Fibonacci sequence, which can be traced to more than a century. However, they are more effective on somewhat longer timeframes, such as a weekly chart vs. a 30-minute chart. To fully understand and appreciate the concept of Fibonacci retracements, one must understand the Fibonacci series.

The Fibonacci levels used are the same as the downtrend calculations, viz. There are also higher levels that are given by the reciprocals of the aforementioned ratios, e.g., 1.618 (an / an-1). As is clear from the chart, the ratios bounce around fibonacci retracement formula for small n, but for n greater than 5, the ratios stabilize. A special property of the Fibonacci numbers is that certain ratios of its elements remain constant. They are the ratios of an element an to its preceding elements an-1, an-2, and an-3.

Fibonacci extensions are very useful for determining exit positions when the price breaks out of the trend, beyond 100%. To obtain the ratios for Fibonacci extension vs retracement, we simply add the usual ratios to 100%, which gives us 1.236, 1.382, 1.5, 1.618, and so forth. The price reaching below 0.382 ($51,463) could be a signal that the downtrend continues.

Because it is so widely followed, it can lead to a self-fulfilling prophecy in markets at times. Once the number sequence gets going, dividing one number by the following number yields 0.618, or 61.8%. Divide a number by the second number, and the result is 0.382, or 38.2%. All ratios, except for the 50% Fibonacci retracement level, are based on calculations involving this number string. Now that you know the formula for Fibonacci retracement levels, you can learn how to actually calculate them.

PrimeXBT products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. In the crude oil market, you can see that we had fallen quite significantly from the $100.84 level to reach down to the $91.87 area. We then bounced from there, and have seen the 0.382% level, or $95.30, offer resistance a couple of times since then. Let’s calculate the retracement for ABC stock at $50 at the 38.2 percent ratio. The stock made a high 3 months ago at $100 and moved to a low of $40 today.

These may include candlesticks, price patterns, momentum oscillators or moving averages. A Fibonacci retracement is a technical indicator used to identify support and resistance levels in a time series of prices or index levels. Unlike many technical indicators, Fibonacci retracements cannot be used directly to generate buy and sell signals. Instead, they are used as guides in conjunction with other indicators to make trading decisions.

‘The retracement level forecast’ is a technique that can identify upto which level retracement can happen. These retracement levels provide a good opportunity for the traders to enter new positions in the trend direction. The Fibonacci ratios, i.e. 61.8%, 38.2%, and 23.6%, help the trader identify the retracement’s possible extent. Moreover, it is suitable for all timeframes, including day trading and long-term investing. However, as with most technical indicators, the predictive value is proportional to the time frame, with greater weight given to longer timeframes. For example, a 61.8% retracement on a weekly chart will provide a far more potent signal than a 61.8% retracement on a five-minute chart.

As a rule, the more indicators to support a trade signal, the stronger it is. In technical analysis, Fibonacci retracement levels indicate key areas where a stock may reverse or stall. Usually, these will occur between a high point and a low point for a security, designed to predict the future direction of its price movement. The Fibonacci retracement golden pocket level is another interesting strategy to have in your technical analysis toolset. The golden pocket is the level between the 0.618 Fibonacci retracement golden ratio and the 0.65 ratio. This zone is the level where the price is most likely to reverse during an uptrend or a downtrend.

1801 South Ocean Drive, Suite C Hallandale Beach, FL 33009

1801 South Ocean Drive, Suite C Hallandale Beach, FL 33009

ДЛЯ БОЛЬШЕЙ ИНФОРМАЦИИ ЗВОНИТЕ НАМ

(786) 797.0441 or or: 305 984 5805